The Stock Market Neopets is a part of Neopets that can, over time, earn you millions of neopoints without you having to do a thing. Before we start, there’s a few essential points.

- HAVE PATIENCE! Stocks may take weeks, months, or even years to rise, but as long as you have PATIENCE, they will rise. Don’t get anxious or worried, even if a stock’s been hovering around 15 for the past month- just take this opportunity to buy more of it.

- NEVER SELL AT A LOSS! Selling at a loss is the stupidest thing you can do. Every stock will rise- every single one! All you have to do is wait.

- DO NOT SELL IF YOU ARE NOT SATISFIED WITH THE PROFITS! If a stock is at 40, but you wanted to sell at 60, then wait until it gets to 60, even if it drops back down to 20 first. It’ll rise again, I promise.

- BUY EVERYDAY! The more stocks you have, the more profit you’ll earn. Simple as that.

- NO ONE CAN TELL YOU WHAT STOCK TO BUY! It’s anyone’s guess as to what stock is going to rise, and there is no magic stock that makes lots of nps quickly. However, not all stocks are equal. Time has shown that some stocks rise higher and more frequently than others, but we’ll get to this later.

The part below is an in-depth guide. It is recommended that you read it, but if you’re not interested in reading through and learning it all, you can skip down to the Easy Guide.

Are stocks random or predictable?

There are generally two opinions as to how the stock market is:

- Random and unpredictable?

- Unpredictable, but not random?

Random – Those who say that the stock market is random, and subsequently unpredictable, believe that Stock A has just as much of a chance to hit 100 as Stock B. They believe that stock prices are random and every stock is equal.

Unpredictable – Those who say that the stock market is unpredictable believe that Stock A is either better or worse than Stock B. They believe that no one can predict when Stock A or B will go up, but it is NOT random.

Personally, I believe that the stock market is unpredictable but not random.

Stock Market Strategy

There are several methods to playing the stock market. First, you have to decide your sell point, meaning at what price you’ll sell. Once you set a sell point, stick to it, no matter how tempting it is to sell or hold. You make more nps in the long run.

The 15/30 Method

The name pretty much says it all! Buy at 15, sell at 30. This method is simple and great for those new to the market. Because many stocks frequently reach 30, this is good for a smaller but quicker profit. The only cons are that the profit isn’t much, and stocks may rise above 30 a share, so you’ll miss out on profit.

The 15/60 Method

This is probably the most popular sell point among most neopets stock market players. Just about all stocks reach 60, and it can happen within only weeks after 15.

The 15/60+ Method

Very, VERY experienced players with portfolios that are MASSIVE are able to set sell points of over 60, sometimes 100 or more! This is because they have so many stocks, at any one time there will be at least one or two companies at 60 or above, so they can afford to wait for the very high peaks. If you don’t have a massive portfolio (Read: At LEAST 100k shares), don’t even think about this.

Obviously, you can set your own sell point, based on your own personal situation. The only rule with selling is to never sell at a loss!

Now that we’ve gotten sell points out of the way, here’s some strategies to playing the market, after you’ve established a good portfolio.

Hyperstocking

Hyperstocking is when you buy many, many stocks in only a few different companies. Most people have less than 10k shares (That’s the number of shares, not the worth!) in any companies, but some people like to buy 20k, 30k, 40k and up number of shares in each company, with only a few companies. The advantage to this is that if Stock A reaches 60, you’ll be able to sell 30k shares and receive 1,800,000 nps from that one sale. The disadvantage is that you may have to wait a very long time to make any profit. Those who hyperstock generally buy at 15-17 only.

Diversifying

This is generally what most people do. They have about 10k or less shares in each company and can have a portfolio of many, many different companies, all with around the same amount of shares in each. The advantage is that if Stock A isn’t rising, Stock B, C, D, or E probably is. The disadvantage is that you’ll be collecting 100k here, 200k there, etc. instead of getting it all at one time like hyperstocking.

I don’t advise hyperstocking because you could receive the same amount of profit with diversifying, but over a longer period of time and with less risk. And there’s always the (extremely tiny) chance that a stock could go bankrupt. What if you had hyperstocked that company? That’s hundreds of thousands of nps down the drain.

Climbing Sell Points

Another method to selling is to set climbing sell points. I personally don’t use this method, but some people do choose to.

Climbing sell points is to set multiple sell points. Let’s say you have 5k shares of Stock A. You set sell points of, say, 60, 70, 80, 90, and 100. When stock A hits 60, you’ll sell 1k shares. If it keeps rising and hits 70, you’ll sell another 1k. When it hits 80 you’ll sell a third 1k, and so on until you have no more shares left. The advantage to this is that you’ll earn more nps than if you had sold all at 60, but the stock kept rising after you sold. The disadvantage is that if a stock peaks at 60 or 70, then goes back down to 15, you’ll still have shares that you haven’t sold, and profit that you missed out on.

Bankruptcy

What is bankruptcy? A stock is bankrupt when its price reaches 0. Once at 0, it’s dead and can never again be of any value.

How often do stocks go bankrupt? Very rarely. The last stock to go bankrupt was JCK, in November 2004. That was almost 3 years ago.

Should I be worried? No, not really. Bankruptcy has only happened to a handful of companies throughout the entire history of the stock market. Your chances of having a company in your portfolio bankrupt are very low.

Stock Market Easy Essentials

So, you want to get to the action already, huh? Well, first make sure you have at least 15,000 nps. I recommend having much more, so you can continue to buy shares every day, but 15,000 is the minimum you need to start a portfolio.

Here is a list of stocks that are selling at 6-19 nps a share: Bargain Stocks

Here is your portfolio: Your Portfolio

Here is where you’ll find the most up-to-date and accurate information on all stocks: NeoDaq

Open that first link in a new tab. You’ll see a table with something like this:

The price under ‘Curr’ means the current price. Look for stocks that are priced 15-17 nps a share (If you only have 15,000 nps, only look for stocks that are 15 nps or less!).

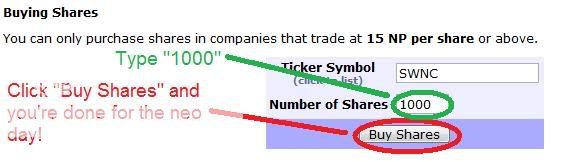

So, let’s say you have your eye on ‘Nimmos,’ which is priced at 15 nps a share. You need to buy them now, so:

- Go to the stock market and log in.

- Click on the ‘Buy’ link.

- Type in the number of shares you want to buy (let’s say 1,000 shares), and enter ‘Nimmos.’ Click buy!

Now you own 1,000 shares of Nimmos, worth 15,000 nps! The market updates every 10 minutes, so you can keep an eye on your stock. Try to get into the habit of checking back to see how your stocks are doing.

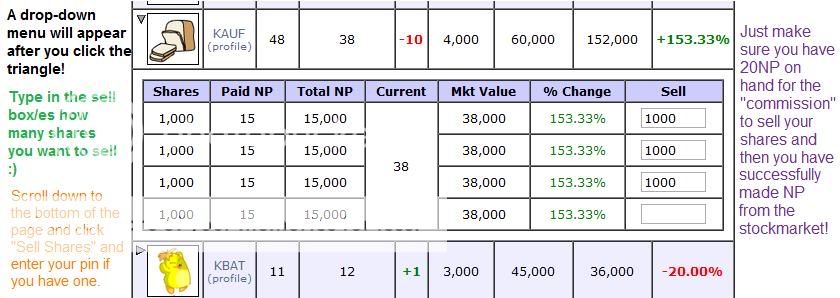

Once they reach 30 or 60, you can sell them! To sell your stocks, click on the ‘Sell’ link, type the number of shares you want to sell, and type in ‘Nimmos.’ Click sell! If you were able to sell all your stocks for 30 nps, you would have made a profit of 15,000 nps, and if you sold for 60, you’d be up 45,000 nps!

If you want to, you can repeat this step until you have enough nps to invest heavily.

Stock Market Avatar – Easy Method!